The Sequencing Advantage: Why Physical Retail Is the Backbone of CPG Scale in India

Over the last few years, India has rightly celebrated the rise of digital-first brands. Beauty, personal care, snacks, beverages—entrepreneurs have leveraged ecommerce and quick commerce to launch quickly, target precisely, and learn fast. Digital has been a brilliant launchpad: it brings reach, agility, and data that traditional channels rarely provide.

But the same levers that spark early growth often strain at scale. Customer acquisition costs climb, discount expectations get entrenched, unit economics compress under logistics, returns, and platform commissions, and performance marketing hits diminishing returns. What worked to get from zero to one rarely gets you from one to ten.

Why Retail Still Wins in India

India’s FMCG story is written in stores. Kiranas, chemists, modern trade, and regional chains still account for the overwhelming majority of volumes. Physical retail concentrates demand, reduces last-mile cost per unit, and builds habit through availability. In a country where trust is local and purchase is often planned and replenishment-driven, shelf presence beats ad frequency.

| Availability drives repetition | If I find you every time at my neighborhood store, you become part of my routine. |

| Pack-price architecture is channel-native | What moves online at a premium SKU doesn’t always move offline; the reverse is also true |

| Unit economics are sturdier | Contribution margin improves when you spread supply chain costs across predictable, batched demand. |

When to Pivot: Practical Triggers

Founders often ask - “When should we shift focus to offline?”

My view - The move isn’t binary, it’s sequenced. Watch for in-market signals that your online-only growth is peaking and your margins are under stress.

- Rising CAC with stagnant repeat: New cohorts cost more to acquire while repeat rates plateau.

- Discount dependency: Contribution margin relies on promotions to hit volume targets.

- Logistics drag: Freight, returns, and platform fees erode gross margin beyond plan.

- Assortment mismatch: High-velocity SKUs online don’t translate to broader household penetration.

- White-space mapping: You can quantify meaningful headroom in priority cities through store-level opportunities you’re not accessing online.

When two or more show up consistently, you’re late to offline.

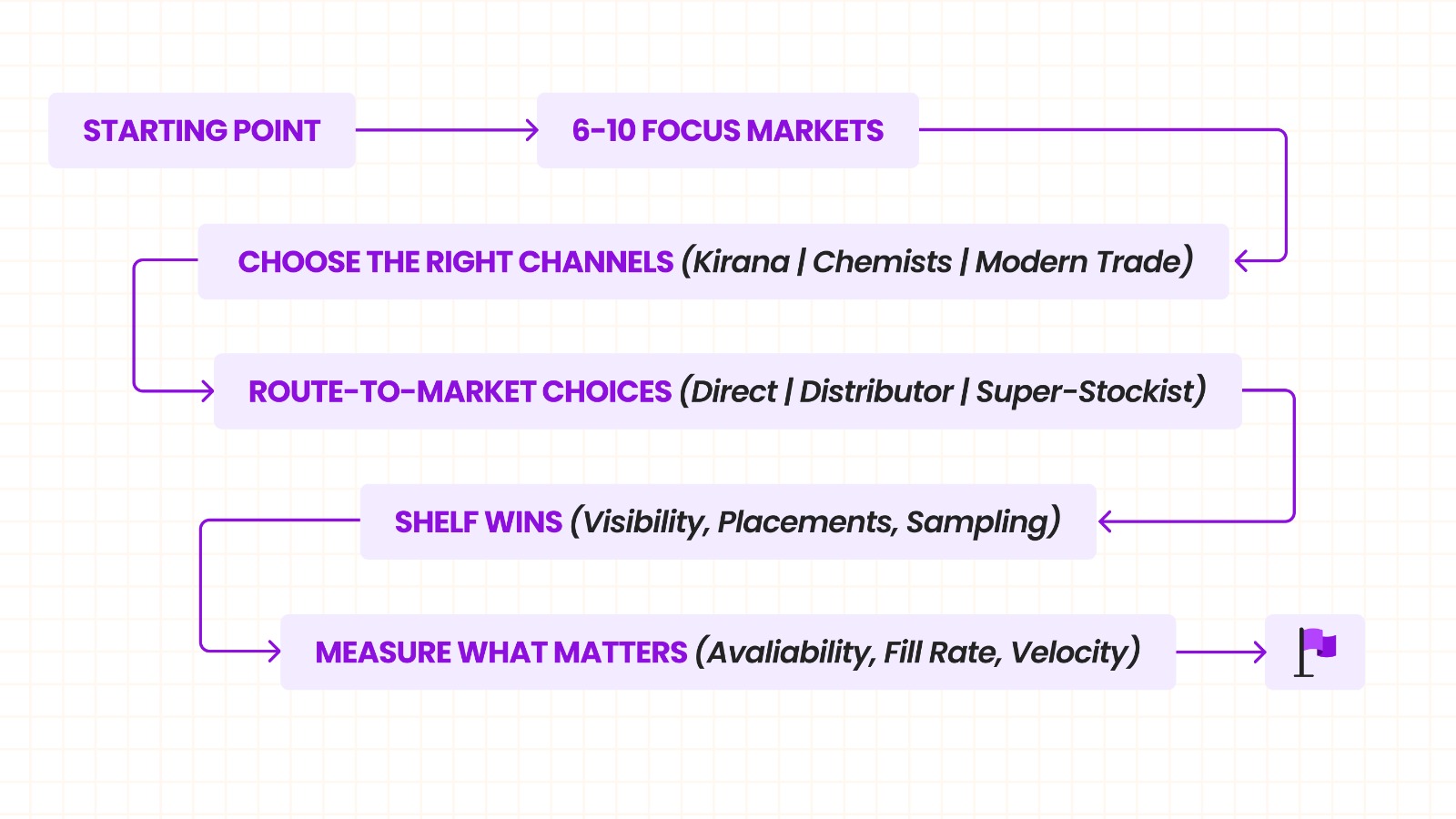

Executing the Offline Scale-up

Moving to retail is not just “listing in stores.” It is a disciplined distribution build, with clear choices and guardrails.

- Start with focus markets: Prioritize 6–10 cities or clusters where your brand already has awareness and strong digital demand. Depth beats breadth.

- Choose channels intentionally: Kirana-heavy categories need general trade muscle; beauty and personal care might begin with chemists and modern trade; snacking can ride both.

- Nail pack-price architecture: Design SKUs for shelf turn, not Instagram. Think entry price points, margin ladders, and channel-exclusive packs.

- Build the right RTM: Decide where to go direct, where to partner with distributors, and where to use regional super-stockists. Align incentives to sell-out, not just sell-in.

- Win at the shelf: Visibility units, secondary placements, planograms, and in-store sampling matter. In retail, awareness is physical.

- Measure what matters: Move beyond ROAS to availability, fill rate, OTIF, weighted distribution, and velocity per outlet. You don’t manage what you don’t measure.

- Protect working capital: Tighten demand planning, reduce SKU sprawl, and move toward a replenishment rhythm that your team and partners can actually execute.

Running Omnichannel Without Margin Burn

The hardest part is not going online-to-offline. It’s operating both without creating channel conflict or bloated costs.

- Set a clear channel role: Use online for launches, feedback loops, and higher-margin bundles. Use retail for penetration and frequency.

- Align pricing and promotions: Avoid undercutting your own shelf. Promotional calendars should be coordinated, not competing.

- Consolidate demand planning: One truth across channels. Fragmented forecasts create stockouts in stores and overstock online.

- Build a single customer view: Even if imperfect, connect consumer signals (digital) with shopper signals (retail) to guide assortment and activation.

- Organize for execution: Separate “brand” from “route to market” capabilities. Great storytelling doesn’t move cases if your feet-on-street and distributor economics aren’t right.

What Will Differentiate Winners

In a market as vast and heterogeneous as India, the winners won’t be those who choose online or offline. They’ll be those who master sequencing.

A Closing Thought

CPG scale in India is a street fight won store by store, distributor by distributor, month after month, where digital is the spark, but retail is the engine.

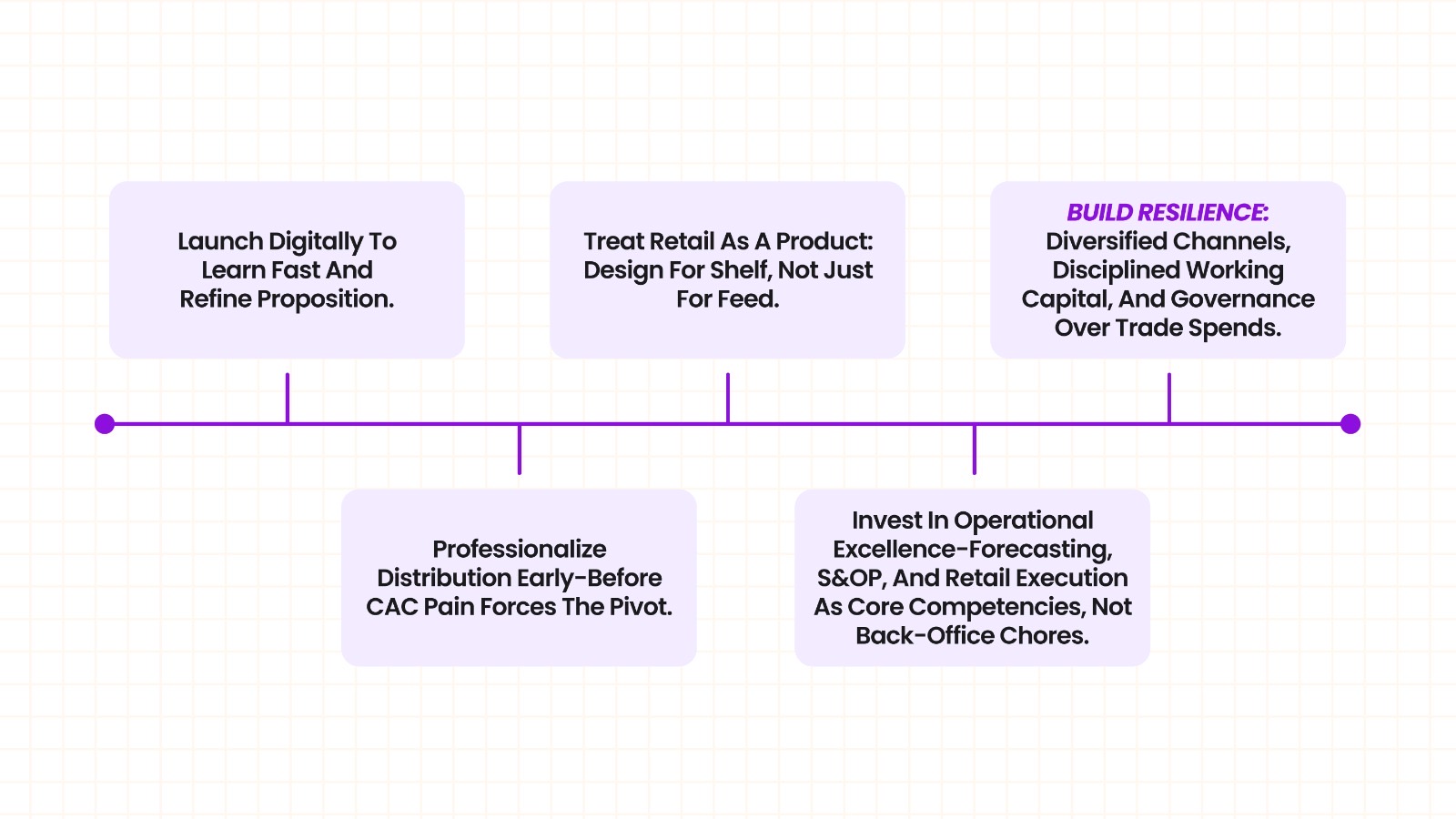

What separates the brands that stall from the ones that endure is not just knowing that reality—it’s acting on it early. The smartest founders don’t wait until margins collapse to build distribution muscle. They treat omnichannel as a design choice, not a crisis response.

The brands that win will:

- Sequence the pivot—learning fast online, then doubling down offline before CAC curves turn brutal.

- Treat retail like a product—engineering SKUs, pack-price ladders, and in-store execution with the same obsession they once gave to performance ads.

- Build systems, not hacks—professionalizing demand planning, trade management, and retail execution while competitors are still fighting fires.

About the Author

Anupam Sinha is the Co-Founder and CEO of Vxceed. With deep consulting and domain expertise, he focuses on helping CPG companies improve sales and distribution efficiency while building strategies for sustainable growth in complex markets.