How AI is Transforming Van Sales Load Planning from a Bottleneck into a Growth Engine

Van sales remain the backbone of consumer goods distribution in emerging markets. For categories like beverages, dairy, bakery, and snacks, where product freshness and shelf velocity define competitiveness, vans bridge the last mile between distribution centers and thousands of small retailers every day. Yet, despite their strategic role, most van networks still operate with outdated loading practices, limited demand visibility, and manual planning norms.

These inefficiencies quietly drain growth. A mid-sized FMCG operator managing around 300 van routes can lose up to 8% of annual revenue through suboptimal loading, high returns, and excess working capital tied up in slow-moving stock. In a market where margins are under pressure and competition is intensifying, that gap is no longer trivial—it is a strategic liability.

The Hidden Cost of Static Van Planning

For many organizations, van operations have remained largely unchanged for years. Trucks are loaded by rule of thumb, not by data. Field teams rely on heuristics—estimating which SKUs to load, in what ratios, and for which routes—often without reliable visibility into store-level demand or current inventory.

The impact is predictable but severe. Stockouts on high-demand SKUs erode sales and customer satisfaction. Slow movers occupy valuable cubic space and capital. Emergency reloads consume fuel and labor hours, while overloaded vans strain working capital efficiency.

Executives recognize these patterns as recurring operational friction. Yet, because they occur in small increments—lost sales here, a wasted trip there—they are rarely quantified at scale. The result is a slow, steady drag on growth, profitability, and capital utilization.

The business case is clear when the inefficiencies are tallied. Across a 300-route network, recurring stockouts can:

- Reduce daily sales by 5–7%

- Reload trips may rise by 20–25%

- Roughly 10–15% of working capital remains locked in excess or unsold inventory.

These are not operational inconveniences; they are measurable financial leaks that erode competitiveness year after year.

From Static Norms to Intelligent Planning

For decades, van loading has relied on fixed norms and field experience — a system that worked when demand patterns were stable. Today, with frequent promotions, shifting consumption, and complex route constraints, those methods can no longer keep up.

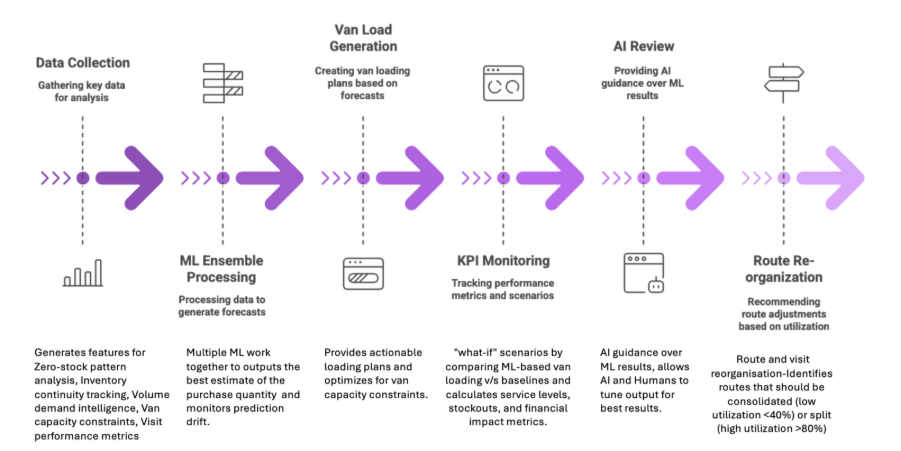

Intelligent planning changes the approach entirely. Instead of relying on standard ratios or assumptions, it anticipates outlet-level demand and balances it with real-world constraints such as vehicle capacity, temperature requirements, and compliance rules. The result: every van leaves loaded for impact, not habit.

What makes this shift powerful is its adaptability. Load plans evolve daily as new data comes in, reducing stockouts, excess inventory, and mid-route reloads, the silent costs that erode margins. Just as important, recommendations are transparent and easy to understand, enabling sales and distribution teams to make confident, informed decisions in the field.

For leaders, the value lies in turning a routine operational task into a system of continuous optimization, one that scales learning across routes, reduces waste, and directly contributes to growth.

The Impact of AI-Powered Van Load Operations

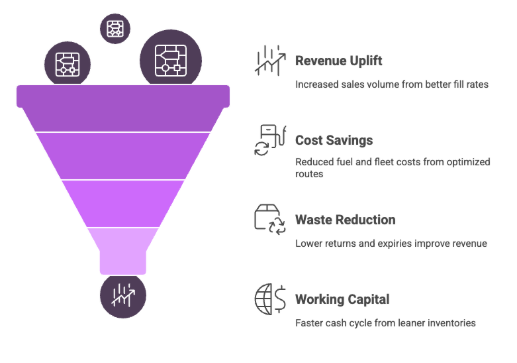

The financial impact of intelligent load planning extends across four dimensions—revenue growth, cost efficiency, working capital optimization, and service reliability—and it materializes faster than most transformation initiatives.

Revenue Growth

More accurate loading means fewer stockouts and fuller shelves. In deployment scenarios, daily route sales can increase by around 7–8% within six months, leading to a potential high single-digit uplift in total network revenue. Enhanced fill rates also tend to improve promotional compliance, allowing companies to realize more value from their trade spend.

Cost Efficiency

Emergency reloads may drop by up to two-thirds—from 3.2 to 1.1 trips per route per day—reducing fuel costs and improving labor productivity. Fewer reloads and higher first-pass accuracy also contribute to lower carbon emissions, advancing sustainability goals without additional investment.

Working Capital Optimization

Vans often operate with roughly 18% less inventory while maintaining service levels. This can shorten the cash-to-cash cycle by about 4–5 days, releasing working capital for more productive use. In perishable categories, lower waste and expiry help improve realized revenue and margin quality.

Service Excellence

The customer experience tends to strengthen measurably. On-Time, In-Full delivery can improve by up to 40%, temperature compliance may rise to around 99%, and stale returns in snack and bakery categories can decline by roughly 30%. Greater reliability builds retailer trust and long-term route loyalty.

The Cost of Inaction

If the ROI of intelligent planning is so clear, why do many organizations delay adoption? The barriers are often organizational rather than technical: data readiness, change management, and comfort with new systems. Yet, inaction carries a measurable cost.

For a typical 300-route network, each month of delay can translate into 5–7% lost route sales, 20–25% higher operating costs, and 10–15% of working capital locked in unproductive stock. These losses are not hypothetical—they represent real value destruction accumulating every month that static planning persists.

In markets where competitors are modernizing their route-to-market infrastructure, hesitation becomes a strategic disadvantage. The cumulative opportunity cost of delayed transformation can exceed the initial investment several times over within a single fiscal year.

Building a Data-Ready Route-to-Market Model

Executives aiming to modernize van operations should focus on three enablers: data foundations , disciplined piloting, and field adoption.

| Strengthen Data Foundations | Clean SKU and route masters are non-negotiable. Historical sales, visit frequencies, and capacity attributes must be validated to support accurate forecasting. |

| Pilot with Measurement | Begin with representative routes to establish a baseline for metrics such as stockouts, reloads, and load factors. Transparent dashboards create a “before and after” view that quantifies improvement and accelerates internal buy-in. |

| Design for Adoption | Field trust determines success. Explainable recommendations, supervisor training, and guardrails (e.g., limiting SKU mix shifts to ±20%) help ensure adoption without disruption. |

Risk mitigation is integral to this process. Gaps in data, abrupt optimizer recommendations, or model drift over time can all be addressed through proactive governance—data remediation sprints, configurable thresholds, and quarterly model retraining. The most successful implementations treat these controls not as safeguards but as continuous improvement mechanisms.

From Distribution Efficiency to Strategic Advantage

Van sales are no longer a low-visibility operational layer; they are the frontline of competitive differentiation. As consumer goods companies confront rising service expectations and volatile demand, transforming van operations through intelligence is not simply a cost-saving measure—it is a strategic imperative.

For leaders, the question has shifted from “Can we afford to modernize?” to “How much longer can we afford not to?”

The evidence is unambiguous. Intelligent van load planning consistently delivers measurable uplifts in sales, cost efficiency, and service quality within the first year of deployment. More importantly, it creates a foundation for sustained advantage: faster market response, stronger retailer relationships, and healthier balance sheets.

In a business where every kilometer, case, and cubic foot counts, data-driven van sales planning is no longer a technological upgrade, it is a leadership decision.

Transform Van Sales from a Daily Challenge into a Growth Engine

Learn how AI-powered load planning helps FMCG leaders reduce inefficiencies, boost route profitability, and convert every van into a driver of business performance.

Request to Access the WhitepaperAbout the Author

Cyril is the Co-Founder and CTO at Vxceed. With over two decades of experience in engineering and entrepreneurship, he focuses on building scalable SaaS solutions that transform demand chain execution and help businesses operate with greater agility in evolving markets.